[ad_1]

First published NOV 15, 2023

Updated 7 hours ago

Tim Murphy

Tim Murphy is co-editor of Newsroom. He writes about politics, Auckland, and media. Twitter: @tmurphynz

Show more

Media

MediaRoom column: Tough times roll on for news media companies, with NZME’s profit projected to slump; Plus, Stuff’s ad-free newspaper

Publisher and radio broadcaster NZME fronts up to investors today and will need to explain how its gross profit is going to fall by up to 12 percent this year.

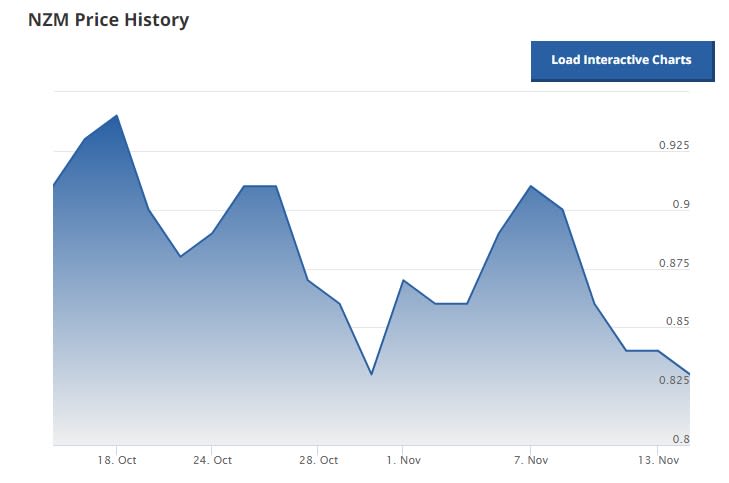

The fall would be its second biggest drop since listing on the NZX in 2016. The firm’s share price, which has been stubbornly low ever since then, was at 83 cents on Wednesday morning, down from 91c before a profit downgrade notice, and just under the original list price.

A notice to the sharemarket last week revealed that anticipated lifts to advertising revenues in the months August to October that were predicted at the firm’s annual meeting did not eventuate, and now the two biggest months of the year, November and December, are not forecast to meet expectations.

NZME expects to make an ebitda (earnings before interest, taxation, depreciation and amortisation) of between $57-59m – down from its last guidance to investors in just August that in 2023 it would hit between $59m and $64m.

Last year the company, owner of the New Zealand Herald, NewstalkZB and many radio stations and regional newspapers, made an ebitda of $64.7 million. Even in the hardest of the pandemic years, 2021, NZME’s ebitda was $62.4m.

NZME has been hard hit by the real estate market downturn. Its latest announcement is despite its OneRoof real estate section regularly talking up the upturn in that market.

The change of government and reported business and consumer confidence improvements have not been enough yet to make the final months of the year positive for the company. “This is not yet consistently reflected in advertising revenue results,” the notice to the NZX said.

NZME’s advertising revenue in the third quarter (July to September) was down 2 percent year on year, making it 11 months in a row of negative results for the business. October was just in the black, up 1 percent on the same month in 2022. “November (the largest revenue month of the year) and December are currently pacing slower, with a number of customer campaigns being cancelled or deferred until 2024.”

NZME promised an update for its shareholders at its investor day today.

“CEO Michael Boggs will address investors and analysts, providing details of NZME’s performance against the strategic targets that were set in its three year strategy in 2020. He will also provide details on NZME’s revised strategy, setting the direction for the next three year period,” the business told the NZX.

—

The company’s main rival in newspaper and digital news publishing, Stuff Ltd, must also be facing those revenue pressures. And there could not have been a starker illustration of the plunging market for print advertising than November 10th’s The Post newspaper (the successor to the Dominion Post).

Friday’s edition featured not one obvious, paying advertisement in its 28 tabloid pages. Nothing at all on its first five pages (usually the highest impact advertising real estate) and then only variations of what the industry calls ‘house’ ads – unpaid filler promotions for Stuff itself and its various products and promotions and sponsorships.

There were two part pages carrying an opaque masthead on the merits of Wellington, which might have been in association with a corporate sponsor, but that wasn’t specified and it might simply have been feelgood content there on its own right.

The Friday edition of the Herald, for all NZME’s struggles and the sagging November market, had a modest sprinkling of ads for retirement villages, superannuation funds, an appliance store and some public and death notices.

The advertising-naked The Post was a jarring start for not only its own journalists but others industry-wide, seeing the visual expression of the industry’s tough times. But, as one commenter on Twitter pointed out, readers might not mind avoiding the ads and having pages chock full of editorial content, paying as they are $3.60 a retail copy.

[ad_2]

Source link