[ad_1]

Since the first cargo of American liquefied natural gas (LNG) left a terminal on the Gulf of Mexico bound for Brazil in February 2016, US exports of the fuel have boomed. In 2023 the US was both the world’s largest producer of natural gas and its largest exporter of LNG, with exports that year totalling 86 million tons.

Natural gas (methane) is burned to generate heat and electricity. Cooling it to -162 degrees centigrade at an LNG plant turns it into a liquid that makes possible transport internationally using specialised ships, LNG carriers.

Pressure was building on the US president, Joe Biden, and his energy secretary, Jennifer Granholm, to review the legitimacy of new licenses for producing LNG at the end of 2023. On January 26, Biden announced a temporary pause on approvals of pending LNG projects until a review could be completed.

The pause will allow the US Department of Energy to update the basis upon which it determines whether a particular LNG project is “in the national interest”. The review will consider the impact of LNG exports on energy costs for American consumers, the sufficiency of domestic supply and the environment, both locally and in terms of climate change.

Biden has not stopped exports from existing projects or construction work on future ones, whether or not they have the necessary approvals. It is only the Department of Energy’s approval process that is under review. The Department of Energy authorises exports to countries with which the US does not have a free trade agreement (FTA) and between February 2016 and November 2023, 80% of all US LNG exported by vessel went to non-FTA counties, among them China, Japan and all European importing countries. In 2023, Europe alone accounted for 60% of US LNG exports.

So, the “pause” will not stop a massive expansion in the capacity of the US to make and distribute LNG. Enough terminals are being built to add 70 million tons of LNG a year, bringing total annual capacity to 160 million tons by 2028. The pause will at least affect the dozen or so terminals yet to be decided on (amounting to about 50 million tons a year).

It is unclear how long the pause on regulatory approvals will last, but an outcome is unlikely before November’s election. The spotlight on US LNG exports is at least a chance to question whether gas should have a place in the energy transition.

Freedom LNG

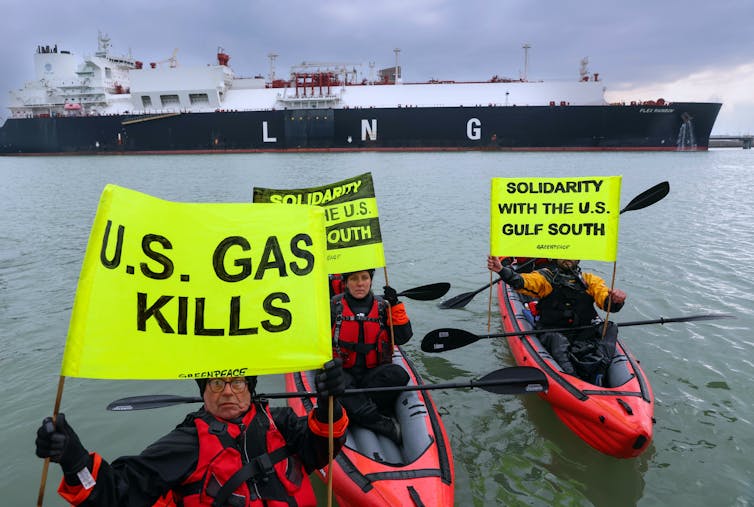

Environmental groups and communities living near LNG terminals (who are exposed to dangerous levels of pollution) have welcomed Biden’s decision.

EPA-EFE/Olivier Hoslet

Republican politicians and the oil and gas industry have been less supportive. One group of senators argued a limit on US exports would not affect the world’s demand for natural gas, but was bad for the American economy and would cost jobs.

The US media meanwhile has portrayed the pause as an attempt by the Biden administration to bolster its environmental credentials ahead of the election. Donald Trump, his likely opponent, vowed to “…approve the export terminals on [his] very first day back”.

The Trump administration described US LNG exports as “molecules of freedom” in 2019 that could reduce Europe’s reliance on Russian gas. This now seems prophetic. Exports of US LNG have played a major role in Europe’s pivot away from Russian pipeline gas since the 2022 Ukraine invasion. However, the US boom has also had a profound impact on the global LNG market.

The traditional LNG model tied producers and consumers into long-term contracts with destination clauses that constrained where LNG could be sold. In effect, a floating pipeline connecting two countries.

Instead, US LNG is sold free on board, meaning buyers (other oil and gas companies, utility companies and traders) take ownership at the export terminal, arrange shipping and sell the LNG wherever they wish. Buyers of US LNG can send cargoes to both Europe and Asia, enabling arbitrage between these two markets, effectively globalising the trade.

Industry and energy thinktank analysis suggests that the liquidity of the global LNG market will be untouched by the pause. It does not affect the coming expansion of US production, which is mirrored by a surge in Qatari output, and so by 2028 the global market may be oversupplied.

Janusz Pienkowski/Shutterstock

US LNG exports to Europe are secure for now, but Europe has pledged to significantly reduce how much gas it burns. And so, there is a lot of uncertainty around gas demand in the 2030s and beyond.

Time to take our foot off the gas?

The LNG industry argues that natural gas is a cleaner fuel than coal, producing about half the emissions when burned to generate electricity. If countries meet future energy demand with gas instead of coal, emissions will fall. However, other analyses highlight the methane that leaks from pipelines and suggest that gas may actually be worse for the climate than coal.

Even if the industry were to address these so-called fugitive emissions, gas-fired power would still warm the planet and countries transitioning to natural gas now will be locked into using it for decades to come, remaining exposed to unexpected changes in its price.

The solution is to leapfrog from coal to renewables and avoid gas as a transition fuel. If this happens, the LNG industry could be building production capacity for which there is no market. Of course, industry analysts predict that demand will continue to grow.

EPA-EFE/Arshad Arbab

The review may compel future export projects to clamp down on methane leaks or impose a ban on new projects, although that seems unlikely. Its outcome may simply be swept away by a new president. But as the world has promised to transition away from fossil fuels, questioning the logic of expanding US LNG exports is a good place to start.

[ad_2]

Source link