[ad_1]

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”

That line is just another in a long series of falsehoods put forth by the professional bullshitters at the National Retail Federation.

Here’s Reuters:

“The main lobbying group for U.S. retailers retracted its claim that “organized retail crime” accounted for nearly half of all inventory losses in 2021 after finding that incorrect data was used for its analysis.”

I have been calling out their nonsense for nearly two decades and was ready to retire my Black Friday debunking of their annual Thanksgiving silliness. I tracked the annual retail sales forecast as a twofold exercise: Avoid forecasts, as they are mostly wrong, and tend to lose investors’ money. And second, be wary of what self-interested trade groups say about their industry; they are lobbyists and cheerleaders, not seekers of truth.1

But since a spokesperson for the NRF admitted they had to remove content from its report on organized retail crime (report from April 2023, produced with hired gun K2 Integrity), I have begun to rethink that.

After six months of relentless propaganda on crime, the NRF had to edit the claim that “nearly half” of inventory losses were organized crime.

It’s not.

The actual number? About 5%, or 1/10 as much.

The simple math problem seems to have been exascerbated by Capital One, which treated ALL SHRINKAGE as retail theft. As Retail Dive reported, the statistic comes from a Capital One Shopping report on retail theft, which treats the NRF’s total shrink number as theft, then extrapolated the numbers by state.2

You can count on C-Suite executives at publicly traded companies to jump on every trend to excuse poor company performance. Early this year, Walgreens finance chief James Kehoe admitted as much: “Maybe we cried too much last year” about merchandise losses. In the past, companies have referenced COVID-19, crypto, inflation, war, and even AI shows in quarterly calls as part of their “contextualizing” revenue and profit patterns.

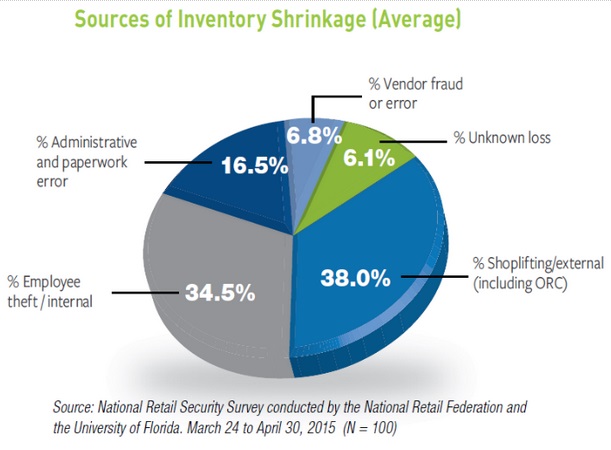

There are many sources of “Shrinkage” of inventory, and while there is some debate as to the largest sources, they look something like this:

Employee theft: It’s the number one source of shrinkage. (My experience: it is often uinderreported by companies). Things “fall off” the truck, Employees steal merchandise, or resell it and keep the cash. This costs retailers anywhere between $15-20 billion annually in the US.

Shoplifting: $10-15 billion per year. Whether its simply walking out with goods, doing smash & grabs or otherwise cheating self-checkouts, it’s the second largest source of retail theft, and a pernicious challenge to all retailers.

Return fraud: Returning stolen merchandise is a variation of shoplifting; note it sometimes (frequently?) involves cooperative employees.

Credit Card Fraud: Has been a huge source of losses; some of it is borne by banks, and more than a little of it impacts consumers, who often are unaware of it.

Vendor Fraud: Light shipments and other forms of inventory shrink before goods even arrive at retailers or their warehouses account for $2-4 billion in losses

Administrative errors: Sometimes these are legitimate errors in ordering,. Logistics, and inventory tracking.

Operational loss, or accidental loss: Any company that buys, ships, warehouses and displays millions of goods a year is going to occasionally break, damage or misplace them. Its normal, and part of any retail business.

Accounting Fraud: Not every store is Crazy Eddies, cooking the books, but more than a few stores have been known to get creative with their inventory management.

The claim that organized retail crime accounted for “nearly half” of inventory losses was false, but it’s also an indictment of modern media. All too often, the truth matters much less than meme production and clickbait.

Who has time to actually fact-check news when something this juicy comes along? That it was obviously false and based on old lobbyists’ reports never seemed to raise any red flags.3

The LA Times called out how silly some of the claims were in late 2021:

“It’s easy to get attention for sensational claims, however, particularly when they come from official sources. Rachel Michelin, president of the California Retailers Assn., told the San Jose Mercury News that in San Francisco and Oakland alone, businesses lose $3.6 billion to organized retail crime each year.

That would mean retail gangs steal nearly 25% of total sales in San Francisco and Oakland combined, which amounted to around $15.5 billion in 2019, according to the state agency that tracks sales tax.

Can that be right? In a word: no.”

And according to NRF data itself, from its annual Retail Security Survey, shrink attributed to external theft, including organized retail crime, has largely remained the same since 2015. Online dasher recently reported that “The average retail shrinkage rate has hovered around 1.4% for over a decade.” In 2022, Retail’s shrink rate rose to 1.6% from 1.4% of sales in 2021, according to the NRF’s annual retail security survey; 1.6% was where the reported shrink rate was in 2019 and 2020 also:

Source: Retail Dive

Source: Retail Dive

A giant media scare was created by those who could not be bothered to check the data, but forth by a clumsy, biased trade group with a history of great exaggeration or outright lying, to cheerlead the interests of its own industry.

Investors should look askance at data and claims from industry spokespeople and trade groups. They all have agendas, none of which include the well-being of your portfolios…

Source:Retailers have a crime problem. It’s in the numbers.The issue is complex and often clouded by imprecise data. Sometimes from the industry itself.Retail Dive, Nov. 29, 2023

See also:US retail lobbyists retract key claim on ‘organized’ retail crimeBy Katherine MastersReuters, December 5, 2023

‘Maybe we cried too much’ over shoplifting, Walgreens executive saysBy Nathaniel MeyersohnCNN January 7, 2023

Retailers say thefts are at crisis level. The numbers say otherwiseBy Sam DeanLA Times, December 15, 2021

Businesses keep complaining about shoplifting, but wage theft is a bigger crimeMichael HiltzikLA Times, August 30, 2023

Retail Group Retracts Startling Claim About ‘Organized’ ShopliftingBy Eduardo MedinaNY Times, December. 8, 2023

Organized journalistic crimeJUDD LEGUM AND TESNIM ZEKERIAPopular.info, Dec 11, 2023

Previously:Black Friday Survey #Fails

__________

1: See also, The National Association of Realtors.

2. We had a Capital One credit card ~20 years ago but canceled it when they refused to lower rates from 18% in 2007 to what they were constantly advertising on TV. (They were very unpleasant to deal with). I am not remotely surprised that basic arithmetic is challenging for this company.

3. More Reuters:

According to NRF spokesperson Danielle Inman, the claim that organized crime accounted for nearly half of all inventory losses was based on two-year-old testimony from Ben Dugan, former president of the advocacy group Coalition of Law Enforcement and Retail. In 2021, he told a U.S. Senate committee that organized retail crime accounted for $45 billion in annual losses for retailers, according to estimates by the coalition.

The inclusion of the claim in NRF’s report was “taken directly from Ben’s testimony” and “was an inference made by the K2 analyst linking the results of the NRF survey from 2021 and Ben Dugan’s statement made that same year,” Inman said.

[ad_2]

Source link