[ad_1]

Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning.

The UK took part in direct military action against the Iran-backed Houthis yesterday, joining the US for the second time in striking eight locations in Yemen. The allies said the targets included an underground storage site and locations used for missiles and air surveillance.

This is the eighth time the US has struck Houthi targets in Yemen since January 11, when President Joe Biden authorised a military campaign in response to the rebel group’s attacks on vessels sailing through the Red Sea.

The widening military effort has raised fears that the US and its allies could be drawn into a wider regional war, even if they say they are seeking to avoid one. Here are the latest details on the military operation.

Go deeper: Car-carrying vessels are being rerouted to avoid the Red Sea, further squeezing carmakers that are already struggling with supply chain issues, shipping executives warn.

Israel-Hamas war: Relatives of Israeli hostages held in Gaza burst into a committee meeting in Israel’s parliament yesterday, escalating a campaign for the government to make a deal to return the captives.

ICJ genocide case: The explosive lawsuit brought by South Africa against Israel at the International Court of Justice has already made waves around the world even before judges issue their decision.

And here’s what else I’m keeping tabs on today:

US elections: Voters in New Hampshire will deliver a verdict on the Republican party’s drift towards isolationism as they choose between competing foreign policy visions by Donald Trump and Nikki Haley at the state’s presidential primary today.

Economic data: The EU releases January consumer confidence figures while the European Central Bank has its bank lending survey. The UK publishes data on public sector finances.

Blinken in Africa: The US secretary of state is set to visit Nigeria as part of a week-long trip to the continent that started on Sunday. In an interview with the Financial Times ahead of the visit, foreign minister Yusuf Tuggar said his country wanted to work with the US to uphold “democratic ideals” in a region rocked by coups.

Companies: 3M, General Electric, Halliburton, Johnson & Johnson, Netflix and Procter & Gamble report. Premier Foods and Associated British Foods have trading updates.

Join the FT’s Martin Wolf and Alec Russell along with expert guests tomorrow as they discuss the challenge posed by migration to liberal democracies. Subscribers can register for free here.

Five more top stories

1. Exclusive: The EU’s $800bn recovery fund has been hobbled by red tape, one of the bloc’s leading industrialists has warned, as data indicates that less than a third of the resources have been disbursed. The NextGen EU recovery fund — often touted as a European precursor to Joe Biden’s Inflation Reduction Act — was “very, very difficult” to access, said the head of the European Round Table for Industry lobby group. Read the FT’s full interview with Jean-François van Boxmeer.

EU politics: European diplomats have privately blamed the UK government’s refusal to rule out a spring election for “delays” to an upcoming meeting of the European Political Community in Britain.

European Central Bank: Christine Lagarde is performing poorly or very poorly as president of the bank, according to most respondents in a union survey of its staff.

2. A tech investment firm led by some of Europe’s best-known start-up founders has raised €400mn to back the next generation of entrepreneurs. London- and Tallinn-based Plural, founded by Wise’s Taavet Hinrikus and UK AI safety tsar Ian Hogarth among others, focuses on early-stage companies, a sector that has suffered a less severe drop-off in funding than later-stage deals. Here’s more on the start-ups it is backing.

More tech: Apple has paid a $12.3mn antitrust fine into Russia’s state budget, boosting the Kremlin’s coffers at a time when it is raising money for its war on Ukraine.

3. Bernard Arnault will nominate two more of his children to LVMH’s board. Alexandre, 31, and Frédéric, 29, will be put forward as candidates, according to people familiar with the decision, joining their older siblings. The move will be watched for signs of which of the 74-year-old patriarch’s five children will succeed him.

4. Labour’s £28bn green investment plan is at risk from Jeremy Hunt’s expected tax cuts. The UK chancellor is expected to use his fiscal “headroom”, which economists forecast could rise by £6bn-£10bn, to give away billions of pounds by cutting income tax or national insurance in the upcoming Budget in March. Read the full story.

UK elections: A new voter identification scheme could be seen as benefiting the Tories, according to the head of the UK elections watchdog.

Sunak’s Rwanda plan: Peers in the House of Lords have dealt a setback to the prime minister’s plan by voting to compel the UK government to show that Rwanda is a safe place to send migrants.

5. Trades by two former top Federal Reserve officials created an “appearance of conflict of interest” with their duties as US monetary policymakers, although they were cleared of any unlawful activity, according to the central bank’s watchdog. The Office of Inspector General said Robert Kaplan and Eric Rosengren had traded securities in a way that could “cause a reasonable person to question” their “impartiality”.

The Big Read

Farming and forestry account for almost a quarter of global greenhouse gas emissions and a hefty chunk of the scope 3 emissions of big food companies originate on farms. As they race to curb their on-farm footprints, some of the world’s biggest food suppliers are pouring cash into regenerative agriculture: improving soil quality by better stewardship such as reduced tilling and planting more diverse temporary pasture. But sceptics warn that it will not be a silver bullet for emissions.

We’re also reading . . .

China’s spy agency: The feared Ministry of State Security is emerging from the shadows to take on a more public and political role as President Xi Jinping seeks to tighten his grip.

Emmanuel Macron: France’s president is pivoting to the right in an attempt to grab voters and prevent far-right leader Marine Le Pen’s rise to power, writes Le Monde’s Sylvie Kauffmann.

Investing: There may be some truth to fund managers’ grumbles that passive investing meaningfully alters the markets, writes Katie Martin.

Finland: The Nordic nation does not fear any provocations or attacks from Russia, presidential frontrunner Alex Stubb said. Read his full interview with the FT ahead of Sunday’s election.

Chart of the day

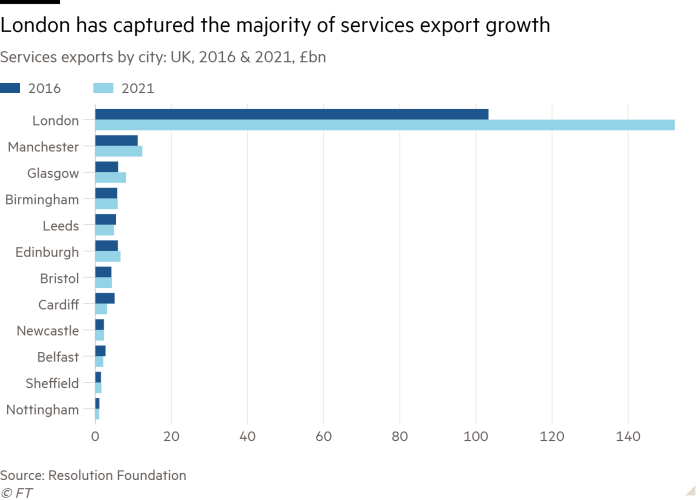

Services have grown to a record share of Britain’s total exports but are increasingly concentrated in London, according to new research that shows the challenges of delivering the government’s “levelling up” agenda.

Take a break from the news

What started out as a cheap, nourishing way of feeding a hungry population in postwar Japan has grown into an obsession among chefs. Ajesh Patalay goes in search of the perfect ramen.

Additional contributions from Benjamin Wilhelm and Gordon Smith

Note: Yesterday’s edition of FirstFT incorrectly stated the release date for the German central bank’s monthly report. It will publish select articles from the report tomorrow and the full report on Friday

Recommended newsletters for you

Working It — Everything you need to get ahead at work, in your inbox every Wednesday. Sign up here

One Must-Read — The one piece of journalism you should read today. Sign up here

[ad_2]

Source link