[ad_1]

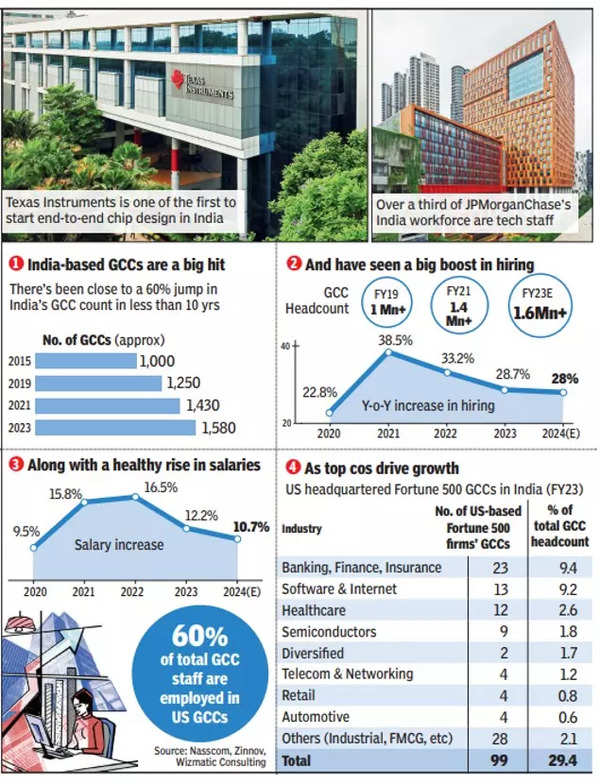

Innovation hubsGCCs in India have emerged as a playbook for innovation hubs. Texas Instruments (TI) India, for instance, is one of the first players to enable end-to-end chip design in the country. “TI engineers play a significant role in the entire chip design process, from concept to design, product engineering, testing and validating, and system software… Some of the best teams in the industry for product development exist here in TI India,” said Santhosh Kumar, TI president and managing director.Goldman Sachs’ India centre has developed Atlas, a low-latency trading platform that hosts a comprehensive suite of trading strategies to help clients achieve their trading objectives, perform historical analyses, build quantitative models with real-time market information, and trade execution. “This platform helped trim microseconds in the execution of trades for our (low-latency trading) clients. The latency reduction from this platform helped us engage existing and newer hedge funds and quant clients,” Samtani said.Recently, GE Aerospace CEO Larry Culp told TOI that the company’s 1,200 engineers at the John F Welch Technology Centre in Bengaluru are involved in cutting-edge work on the future of aviation – including the Leap engine for narrow-body aircraft, the GEnx in the wide-body space, and the next-generation Rise platform for the narrow-body market. The company also announced an investment of over Rs 240 crore to expand and upgrade its manufacturing facility in Pune. The factory already produces components that are supplied to GE’s global factories, where they are used to assemble engines like the G90, GEnx, GE9X, the world’s most powerful commercial jet engine, and the Leap engines by CFM, a GE and Safran joint venture.Moving up the value chainSangeeta Gupta, senior VP and chief strategy officer at Nasscom, said India will continue to be central to the growth of GCCs, making significant impacts across economic, human capital, innovation, social, and environmental dimensions. “Talent will be a key driver of this growth, with both new and established centres expanding their capacities. There’s a notable shift towards incorporating corporate functions, analytics, and AI, with tasks increasingly focusing on corporate functions, product management, decision support, and embedded systems capabilities.”Gupta added: “GCCs are increasingly important to their parent enterprises, focusing on moving up the value chain, creating opportunities for future leadership, and enhancing their overall impact.”Ramkumar Ramamoorthy, partner in tech growth advisory firm Catalincs, said, “With several hundred GCCs gaining critical size, I expect their employment numbers to accelerate from here. I will not be surprised if the GCC headcount crosses 4 million in India in the next five years. The other big impact that today’s GCCs are making is the transfer of technology through R&D, and knowhow in newer areas such as product development and management, AI, cyber engineering, edge computing, synthetic biology, etc. The fact that ISB, IIMs and IITs today offer advanced programmes in product management is a case in point.”As the boundaries blur between tech and traditional industries, GCCs are becoming talent hotspots in newer areas like full-stack development, AI, IoT, embedded systems, and automation, reshaping global markets. “Established GCCs are nurturing advanced skills beyond pure technology, including product management and architecture, where they are building deep domain expertise. This shift enables them to deliver higher-value work and gain a more comprehensive understanding of business contexts,” said Pari Natarajan, CEO of global management consultancy Zinnov. Its research showed that the number of global roles in GCCs in India is projected to grow from a mere 115 in 2015 to 30,000 by 2030.Better salariesLalit Ahuja, founder of Bengaluru and US-based ANSR, which has set up over 120 GCCs, said GCCs have emerged as good paymasters, outshining their IT services peers in several roles across firms. Around 100 Indian GCCs have top leaders netting nearly $1 million in annual compensation, which includes cash and stock rewards, Ahuja added. These roles include India-based site leaders and senior VPs who lead technology functions.

Arindam Sen, EY India Global Business Services & Operations partner, said roles like CIO, CTO, chief financial officer, chief procurement officer will be increasingly based out of India. “People from these centres are growing within the organisation and assuming these roles. Either the role itself sits here or people selected from these centres as part of their talent strategy are eventually taking up those roles.”

[ad_2]

Source link